Sunday, December 31, 2006

Year in Review: Ok, was 2006 a Replay of 1926 or 1929?

(Whether it was the crash, the credit contraction, the protectionist measures that followed, or a combination that made it so deep and brutal isn't completely relevant for purposes of this discussion)

A lesser known, but geographically brutal crash happened in Florida Real Estate in 1926. By the turn of the year, they were already running out of greater fools. But that fall's hurricane season was a doosy. Here is a small snippet from this link http://xroads.virginia.edu/~hyper/Allen/ch11.html:

"After the Florida hurricane, real-estate speculation lost most of its interest for the ordinary man and woman. Few of them were much concerned, except as householders or as spectators, with the building of suburban developments or of forty-story experiments in modernist architecture. Yet the national speculative fever which had turned their eyes and their cash to the Florida Gold Coast in 1925 was not chilled; it was merely checked.

Florida house-lots were a bad bet? Very well, then, said a public still enthralled by the radiant possibilities of Coolidge Prosperity: what else was there to bet on? Before long a new wave of popular speculation was accumulating momentum. Not in real-estate this time; in something quite different. The focus of speculative infection shifted from Flagler Street, Miami, to Broad and Wall Streets, New York. The Big Bull Market was getting under way. "

While the link provided provides a mindbending look at the 20's with all of its similarities to the world we are living in now, I suspect there is a difference.

I believe the Florida Real Estate bubble of 1926 is analogous to the dot-com stock craze. And, the US (global) RE bubble underway right now, is analogous to the 1929 "black tuesday" crash.

Hey, it is "different this time"! The order is reversed! Stock bubble, *then* Real Estate bubble :)

While the dot-com crash and the Florida Real Estate bubble were devastating to those involved, the broader public, not involved in the industry, diversified, or with time before retirement to recoup losses, didn't feel the pain as directly or deeply as the Great Depression.

Today, the sheer number of specu-vestors (both aware and otherwise of what they are doing) and the amounts of leverage and suspect credit being employed are analagous to the 1929 stock market "crash". The difference of course, is that in 1929, stockholders with too much margin were liquidated out of their accounts "automagically" by their brokers as their equity became too low to justify their holdings, creating a self-reinforcing vicious cycle down.

Since margin calls happen within a matter of days it all happened within a few weeks of the first signs of "cracks" in the liquidity of the general market.

But what about residential real estate?

The foreclosure, short sale, auction, or REO sale takes *considerably* longer. In fact, if a borrower continues to make payments on his or her loan, a bank cannot go after a technically "underwater" borrower to make a payment to bring up their equity coverage....

However, what we've seen in the past, is that although there are some that will ride out the cycle and continue to pay down on a loan that is more expensive than the underlying asset, there are a large number that won't.

A large number of specu-vestors will continue to "feed their alligators" (debt burden). However, as transactions become more scarce, it will effect a large portion of the economy that relies on new building and real estate transactions to live. Cracks in the employment picture should create the first "rush to the exits" in 2007 -- especially as inventory balloons.

However, compared to a stock market crash it will be like watching a "slow moving train wreck". It will take months and YEARS to play out. Like I've said before on this blog, if you are tempted to step in and buy something with all these bargains around next year:

Don't catch falling chainsaws....

while they are running....

in the dark...

between your legs!

wait for median incomes to median home prices to get to 2.5ish

wait for rent vs. own to be a breakeven proposition assuming NO APPRECIATION

and, even after that, consider what might happen to property taxes if governments start hurting for revenue while a bunch of boomers start retiring and demanding services that local municipalities can't afford.

The reality is, that even if you buy your home in cash and self-insure, u still don't really own it if someone can tax u at any rate they deem politically expedient at the given time.

ciao for now,

fuBarrio

"Turnings" in Uruguay

The book's premise is that all history runs in cycles, roughly encompassing the length of a long human life 80-100 years.

Each generation's maturation is divided up into 4 parts running about 20-25 years each, and there are 4 different generational types, which come in predictable order, one after the other, every cycle.

The generations' quirks help shape history and vica versa.

"Talkin' bout my Kennel-Ration" (tender chunks)....

It turns out that the generational architype that I fall smack in the middle of is called the nomad type (Gen X).

Nomads are described as:

- distrustful of institutions

- cynical

- grow up "too fast" and "underprotected"

- pursue money first and foremost in early life and get burned out early and often

- view the world as cruel and expect nothing from it.

check, check, check, check, check

- They are typically viewed (and portrayed) negatively by those older than them.

Other Nomad generations were the "Lost Generation" -- came of age in WWI and spent early adulthood in the 1920's --- Hemingway and F Scott Fitzgerald are examples of these

Rhett Butler and Scarlett O'Hara are a fictional version of Nomads in the cycle before the "Lost"

So what about the other generations?

The books says that when "prophet" types (baby boomers) come of age, they lead to great spiritual or "consciousness" revolutions (and neglect of their nomad offspring) 60's & 70's

When "hero" types (older GI generation and current Gen Y are examples) come of age, they will be led by those same greedy stupid (my edit) boomers into cataclysmic apocalyptic meltdowns that generally suck.

Kinda makes sense, since a couple years in the texas air national guard doesn't really qualify one understand what asking someone to disrupt themselves in the prime of life to go play with degraded uranium, or jump on a grenade to save a buddy in a pointless conflict really means....anyone with even a clue wouldn't be nearly as cavalier about it....duh.

"Turnings"

The book characterizes the generational changes as "seasons" or "turnings" -- four turnings that have happened repeatedly throughout history, always in the same order.

The first turning is after a cataclysm -- like WWII. Conformity and grand civic gestures. Think: Eisenhower's America.

The second turning is a rebellion against conformity, an "awakening" -- Think: Summer of Love

The third turning is an "unraveling" where pessimism about the future, youth, and direction is rampant....individual ideals are pursued -- Think: 1984-2004ish (remember book was published in 1997)

Fourth Turning is when the Sh#t hits the proverbial fan and everyone pulls together and "makes it" or doesn't.

Who cares?

Well, it's pretty obvious that the authors are predicting some rocky times ahead for the US. I'm so far in that camp that it doesn't even warrant a post on this blog. To me this is a foregone conclusion. I've tried to softsoap it in the past, but the US is heading for major trouble -- worse (financially and security-wise) than it's already seen with the dotcom blowup and 9-11.

I thought this was a blog about Uruguay (?)

However, the interesting question that still remains (at least for me): can a different geographical location be on a completely different path (turning) or cycle? Or have we become too interconnected.

By all rights, Uruguay has gone through a couple of challenges that seem *close* to a big event -- the coups in the 70's....the financial meltdown early this decade might be another candidate.

If the coups were a Fourth Turning, they could be ready to exit the "conformity" stage....and if the pattern were to hold, they would be already entering an "awakening" stage. (There are already some signs. Protests are very active here. And people are expressing regret over former conformity e.g. voting to give former coup leaders amnesty off for their crimes against the previous regime.)

The last time the Anglo-Euro world entered a fourth turning (the great depression and WWII) south america vaulted to fantastic wealth by virtue of staying out of the conflict and selling supplies to both sides of the conflict. I'm not certain that can be accomplished again.

Obviously, i need to do more research on this topic as it relates to Uruguayan history.....In addition it should be noted that all my present day observations are a mere glimpse of Uruguay through a "nomad's" eyes, without the benefit of time to gauge changes in attitudes and behaviour directly.

ciao for now,

fuBarrio

Wednesday, December 27, 2006

Talk about "Dead Money"

Golden Lotus informed me that it was bad "ju-ju" (sp?) to "tour" where dead people are laid to rest.

Golden Lotus informed me that it was bad "ju-ju" (sp?) to "tour" where dead people are laid to rest.Yet here I find myself, along with a fair number of tourist walking through the cemetary in Buenos Aires, fairly fascinated. This "graveyard" stretched on for blocks and blocks, with each mosoleum uniquely designed.

I was left to imagine what it must be like to be lost in the maze of gravemarkers at night as several of the rows are quite narrow to pass through, nooks and crannies abound, and there is no shortage of the "heebie-jeebies" i'm sure.

Stray cats are plentiful enough here for any number of cliche, hollywood style "faux scares" if one were to try to circumnavigate the space after dark. ("faux scares" of course are when a kitty jumps into the screen and scares the actors at the height of tension....only to be followed moments later by a knife-weilding masked psychopath).

However, during the day when we visited my mind was drawn towards one of the real, deep, dark, bone-chilling fears of fuBarrio.

TAXES!!!

In California, and some other locations I'm sure, they have passed laws to "protect" long term homeowners from property tax hikes driving them from their homes.

Is this how gravesites work? How are the property taxes on a graveyard paid? By the new entrants? btw, indirectly, that is what happens when you have property tax caps. Newcomers and those not lucky enough to have owned their home since the 70's are stuck paying vastly more property tax for the same amount of services.

In addition to the taxes of course, these monuments take a fair amount of maintenance. Most of the owners' sites were relatively well cared for, beautiful examples of late 1600's "creepy-revival" architecture. However, some had obviously fallen into disrepair (a disproportionately very small number.

I wonder if this was from a lack of heirs, their "HOA" fees going overdue, or the annuity they set up to pay for the maintenance being leveraged into drkoop.com stock.

Anyways, points to ponder in one of Buenos Aires' more beautiful areas.

ciao for now,

fuBarrio

Monday, December 25, 2006

fuBarrio's Colon-ectomy

Obviously, given fuBarrio's canine like tendencies, it was only a matter of time before, he would be driven to "sniff out" a place called Colonia (Culonia?).

Colonia sits west of Montevideo, on the Plata river, a one hour ferry ride from Buenos Aires.

While a little bit touristy, and the main streets were a little bit overrun with scooters and trucks driving by slowing with giant speakers advertising crap that Argentinian tourists must buy, Colonia was downright pleasant.

It turns out that Colonia is no"hole" at all....

fuBarrio had imagined that there was a mixup at the hospital where south american cities are born. Buenos Aires should be called Colonia and vice versa.

However, once I realized that Colonia had something to do with "colony" and Cristobal Colon, his suggestion letter to Colonia's local chamber of commerce seemed a bit silly.....

ciao for now,

fuBarrio

Saturday, December 23, 2006

What, me worry?

Merry xmas, everyone. I spent some time this week checking out Colonia, Buenos Aires, Punta del Este, and some other beaches to the "north" of punta.

I'll post some pics and commentary when i get a chance. But for now, let me just say that I'm satisfied with my selection of Montevideo over Buenos Aires.

Ciao,

fB

Friday, December 15, 2006

"We Lose $.04 on every Unit Sold....

United States Mint Moves to Limit Exportation & Melting of Coins

Interim Rule Goes Into Effect Immediately

WASHINGTON — The United States Mint has implemented regulations to limit the exportation, melting, or treatment of one-cent (penny) and 5-cent (nickel) United States coins, to safeguard against a potential shortage of these coins in circulation. The United States Mint is soliciting public comment on the interim rule, which is being published in the Federal Register.

Prevailing prices of copper, nickel and zinc have caused the production costs of pennies and nickels to significantly exceed their respective face values. The United States Mint also has received a steady flow of inquiries from the public over the past several months concerning the metal value of these coins and whether it is legal to melt them.

"We are taking this action because the Nation needs its coinage for commerce," said Director Ed Moy. "We don't want to see our pennies and nickels melted down so a few individuals can take advantage of the American taxpayer. Replacing these coins would be an enormous cost to taxpayers."

Specifically, the new regulations prohibit, with certain exceptions, the melting or treatment of all one-cent and 5-cent coins. The regulations also prohibit the unlicensed exportation of these coins, except that travelers may take up to $5 in these coins out of the country, and individuals may ship up to $100 in these coins out of the country in any one shipment for legitimate coinage and numismatic purposes. In all essential respects, these regulations are patterned after the Department of the Treasury's regulations prohibiting the exportation, melting, or treatment of silver coins between 1967 and 1969, and the regulations prohibiting the exportation, melting, or treatment of one-cent coins between 1974 and 1978.

The new regulations authorize a fine of not more than $10,000, or imprisonment of not more than five years, or both, against a person who knowingly violates the regulations. In addition, by law, any coins exported, melted, or treated in violation of the regulation shall be forfeited to the United States Government.

The regulations are being issued in the form of an interim rule, to be effective for a period of 120 days from the time of publication. The interim rule states that during a 30-day period from the date of publication, the public can submit written comments to the United States Mint on the regulations. Upon consideration of such comments, the Director of the United States Mint would then issue the final rule.

Those interested in providing comments to the United States Mint regarding this interim rule must submit them in writing to the Office of Chief Counsel, United States Mint, 801 9th Street, N.W., Washington D.C. 20220, by January 14, 2007. The interim rule appears on the United States Mint website at www.usmint.gov. The United States Mint will make public all comments it receives regarding this interim rule, and may not consider confidential any information contained in comments.

Contact:

Press inquiries: Michael White (202) 354-7222

Customer Service information: (800) USA MINT (872-6468)

(right now, the margins are so slim that people haven't got any interest in hoarding....which would be a more likely early consequence than melting/defacing. however, if the value of the base metal content in our coins were to 2x or 3x from here we could get the beginnings of a wakeup call to all those still in the dark)

ciao for now,

fuBarrio

Thursday, December 14, 2006

Chicken bones, tea leaves, cups & handles

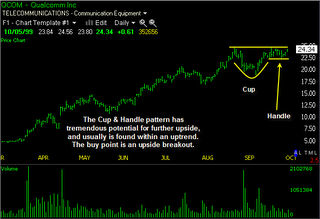

I've been known to equate technical analysis to driving down a windy road and attempting to steer while looking only out the rear view mirrors.....It arguably has some value until an unforeseen news event (Mac Truck) hits you head on at about 85MPH.

That said, there are a couple of chart "patterns" that *seem* to have a higher predictive value than others of future price movements.

The one I'm going to talk about here, as a followup to my post from a couple of days ago is the "Cup and Handle". The first image below is an artists rendering of what would be considered the basics for a cup and handle formation.

The line as it move between A and D is the "cup". E is the bottom of the handle.

While the first image could likely be called a cup and handle -- especially indicative of a classic cup and handle is the volume dropoff in the bottom of the cup and handle. One way this is described is that the holders of the security are "strong hands" and interested in holding at the given price....not panicking out.

However, some believe that the Cup and Handle is most predictive of future price movements in assets that have already established indentifiable longer term trends...that's funny..."duh", huh?

The chart in image two shows the preceding run-up and then the cup being carved, a test of the recent high, a smaller pullback than the previous "cup", and a "retest" of the previous high at the far right of the chart (far right of the handle).

A technician might describe this as a "constructive chart" given that the stock in question had been given enough time to "catch its breath" and let long term holders, new sellers and new buyers reposition themselves.

The theory is, if on the "retest" the stock meaningfully breaks the previous high that shows up as the top of the cup and handle formation, it will attract a lot of attention from momentum players and those that follow such chart setups. The most obvious indication that something like this is underway is a jump in the volume along with the "breakout" to the new high in price as seen in the third chart.

One can argue that with the number of people following these chart formations that they are almost self-fulfilling prophesies. However, it is interesting to point out that before the days of advanced technical analysis, realtime charting, PC's, etc., successful speculators like Jesse Livermore around the turn of *last* century advocated "buying on strength", leveraging up on breakouts, and "selling on weakness....seemingly heresy given the pervasiveness of the "buy low sell high" paradigm.

The fact that speculators buying breakouts amassed great fortunes over 100 years ago, before the widespread popularity of modern charting, seems to argue that it is actually a reflexion of a deeper pattern that imerges within the context of market driven mass psychology, rather than solely the technical analysis tail wagging the greater market dog.

One take on the mass psychology driving such price behaviour might go something like this:

One can imagine a security in a solid uptrend when a bit of news or an important "psychological" price point (like nearing a round number or well-traded option strike price) gives some long term holders the impetus to book some profits.

Once it becomes obvious that the security will not move higher in the immediate term, this selling can accelerate....after a bit of a pullback, the number of those willing to part with the underlying decrease....absent a signifcant piece of news, it is likely the stock will carve along the bottom of the "cup", slowly building support for a higher price.

Speculators who missed the last runup and now see the shares as "cheap" start to take positions...the stock slowly starts climbing towards its recent high, the high marked before pulling down into the "cup".

As the price reaches the previous high, there are a number of holders who are kicking themselves for missing the previous high and watching their paper gains evaporate. In addition, there are some unfortunatey late comers to the party who bought near the top who have been under water and sweating it out.

These are "weak hands" and have likely promised themselves to not be so stupid the next time they get such a gift of a high price, or once they break even (in the case of the late comers).

If the fundamental situation, or news flow has not changed dramatically enough to render the previous resistance irrelevant, the price will likely pull back again once reaching the previous high, thus marking the other side of the cup.

The previous selloff, balancing out of supply and demand, and subsequent runup plays out again...only this time the number of people is fewer than in the previous drawdown and we see the chart form a "handle" to go with the cup.

The shallowness of this drawdown (compared to the cup) means there are fewer anxious owners waiting to sell....As the stock approaches the breakout point for the third time it is like dry tinder waiting for a match.

The "match" could be any positive news or a change in the underlying fundamentals that effect the security or asset in question. The positive news, coupled with the new high garners attention from the media, traders, and technicians who watch for such "breakouts".

The "breakout" becomes a self reinforcing, virtuous circle, until the asset has reached a new higher price.

.......

Ok, so why don't people just buy the bottom of the cup or the handle and get the secuity at a lower price? The "breakout" or even the double top is seldom obvious or definitive until it happens...As easily as an asset could carve out a cup and handle, it could simply roll over....until there is a definitive breakout, the cup and handle could just as well have a NEGATIVE event turn the price action into a triple top.

So you're probably saying, "I'm not a trader, so why all this talk about cups and handles?"

Well, while the cup and handle, driven by mass psychology on the way up, the same psychology, in reverse drives upside down cups and handles or "inverted" cups and handles (sounds like a "top gun" manuever).

See the chart to the left for a longer term view of the dollar in action.

Here the author is trying to point out a head and shoulder chart formation -- however, the part I'm most interested in is the little shoulder off to the right hand side of the chart.

In the last chart I attempt to "zoom in" on this period, covering the last couple of years. I'm guessing, purely guessing here, that we should see some relief in the slide of the dollar (for a spell) however, if and when it should break the 80.50'ish neck-line (or bottom of the upside down cup and handle) it could well set off a quicker move down.

I'm guessing, purely guessing here, that we should see some relief in the slide of the dollar (for a spell) however, if and when it should break the 80.50'ish neck-line (or bottom of the upside down cup and handle) it could well set off a quicker move down.

Of course, like always, you are getting your advice from a bald dog with greyed out eyes and bad teeth over the Internet, so consider the source before acting on it in any way that could damage your financial, mental (or physical!) health.

ciao for now,

fuBarrio

Wednesday, December 13, 2006

That *was* my Good Side.....

Recently it's been brought to my attention that the picture in my profile didn't capture me at my most "cuddly"....The words are commonly phrased something like, "damn that is ONE UGLY DOG"

In an attempt to show my "good side" I enclosed another photo recently taken in support of my upcoming media blitz.

Mind you, this is a very recent (and untouched) photo, so hopefully before it get published in my press release the artists will blot out some of my age spots! :)...but as Golden Lotus reminds me daily, it's up to me to let people see the warmth in my heart!

ciao for now, your faithful servant.

fuBarrio

There is No Inflation in your Currency....

While not everyone yearns for the nostalgia of yesteryear, lately keeping pace seems to be taking more and more of a toll.

Luckily for most Americans, whose wages have been stuck in neutral the last several years, the Fed informs us that there is no meaningful uptick in "core inflation"....whew!

That's a relief, because otherwise if prices were going up, with stagnating wages, we wouldn't be able to maintain ourselves in the styles to which we've become accustomed....Lucky for most American's they don't use "volatile" food, energy, or anything else the gov't finds inconvenient in calculating the inflation rate.

But, I've already said too much...The article below, while a *bit* dated, says it so much better than fuBarrio ever could...to imply that the fed was "fooled" by faulty inflation data, or that they don't have perfectly sound and rational reasons for understating inflation data is being REALLY generous though.

John Crudele, NY Post:

HOW YOU MAY HAVE KINDA SAVED $392.10

November 16, 2006 --

"YOU will be happy to know that your household costs actually went down in October because of that light truck you didn't buy. I don't mean to mess with your head this early in the day. But the declining costs of light trucks was a major reason the government earlier this week was able to announce a surprise 1.6 percent drop in producer prices for October. If you believe the U.S. Department of Labor - whose statistics rarely make much sense - we are on the verge of another deflationary episode like the last one that never happened."

"I'll explain about deflation scares in a minute. But first, let me talk about light trucks. I didn't buy a light truck last month, and I'm guessing that you didn't either. Yet as insignificant as the price of these vehicles is to the average American's budget, a $392.10 drop in light-truck prices did help the government conclude that the producer price index (PPI) declined."

"Wow! It almost makes me wish I needed a truck. And I'm almost tempted to buy one - except that the price didn't really drop $392.10. (Remember that lies are always best when told with precision - hence the 10 cents.)"

"In fact, the new light trucks that reached showrooms this fall didn't really go down 9.7 percent in price as the government implies. Washington simply concluded that the new models are so much better than last year's class that buyers got more for their money - and a price break."

"How did the Labor Department come up with the $392.10 figure? It said that you got an extra $160.09 (notice again the precise number) in extra value from new federally mandated and non-mandated safety improvements "such as tire pressure monitor systems, stability control and airbag system improvements." And you got another $58.01 in powertrain improvements, plus another $174.00 in value for "other quality changes." These include "changes in levels of standard and optional equipment." Voila, the price went down even if it really went up."

"Hedonics (a word that I've been barred from using ever again) and an assortment of other such razzmatazz allows Washington to report lower inflation, which automatically makes economic growth look stronger than it is, which in turn allow politicians to proclaim that an economy is great when it isn't, which ultimately gets them thrown out of office."

"But on a more pernicious note, these inflation tricks can also fool economic planners like the folks at the Federal Reserve. Recently the head of the Dallas Fed, Richard Fisher, complained that Alan Greenspan's Central Bank kept interest rates too low because it had been tricked into thinking the nation was on the verge of deflation. He said the Fed was incorrectly worrying about deflation. "In this case, poor data led to a policy action that amplified speculative activity in the housing and other markets," Fisher added."

"In other words, if you bought a house at a price that turns out to be too high, you can blame bad data caused by hedonic adjustments to light trucks that makes the PPI looked tamer than it really is. Today, the government will announce its October Consumer Price Index. It too will be nonsense."

ciao for now,

fuBarrio

Sunday, December 10, 2006

"get your affairs in order"

I attribute the rule to Donald Coxe. Page one and page 16 refer to a section of a traditional newspaper, page one being the front page, and page 16, the back.

Simply put, by the time a story has reached "page one" most of the return has already been extracted from a trade based on that "news"....and a significant risk of reversal is lurking. Information "hiding" on page 16 is where most of the profitable trades exist.

One of the reasons that I really miss CNBC, and have found it diffcult to gauge sentiment while offshore, is that CNBC was a pretty reliable indicator of news that was known to "everyone"

I remember asking my friend, while talking on the phone the other week, "is anyone even noticing the dollar? are they discussing the ramifications?"

I got my answer this weekend when I read a story that showed that the Economist this last week did a negative story on the dollar, showing president Washington's jaw dropping. The Economist, while a fine publication, has several uncannily timed front page (page one) stories that mark turning points in the underlying security in question.

It turns out that the last time the Economist had a negative dollar story was the low in 2004 that held this time again -- in the vicinity of 80 -- .

I suspect that the dollar chart will show an inverted "cup and handle", and the next time it challenges 80 and breaks it, technical selling and "black boxes" at the institutional money houses will be lighting up across the board.

In the meantime, unless you believe there is a fundamental shift underway that would support the dollar longer term (and thus indicated a double bottom) you should probably take the "handle" phase of the correction as a chance to 'get your affairs in order'.

I will be adding and editing this post over the next day or two to explain what in the h.e.double-toothpicks and "inverted cup and handle" is and why the cup and handle is such a reliable indicator of market psychology that (at times) drives buying/selling behavior in a semi-predictible fashion.

ciao for now,

fB

Friday, December 08, 2006

Reflexivity

G. Soros focuses his finance book on the concept of "reflexivity" I listened to his book on tape while enduring the daily drudgery of early morning commutes from east bay to silicon valley a couple of years ago.

While I understood the words he was saying, I wasn't really "getting it" until recently when some other thoughts tied the idea together for me.

Buy low, Sell high

This is perhaps one of the oldest mantras heard in retail investing, however, in practice a deceptively difficult thing to accomplish.

Why?

Well, traditional thinking and economic theory would lead one to believe that there is some "correct" price for a given asset. Since "markets will fluctuate" (JP Morgan), this traditional approach to investment would drive a trader, to buy when he perceived assets as relatively cheap by some historical measure, and attempting to sell when "expensive".

Traditionally, I've thought of the "natural price" or "right price" as being like a "magnet" drawing the price towards its magical point of balance any time it strays too far....

Traditional economic theory tells us that according to the "efficient markets" theory, that things should be priced about right given an equal number of motivated and informed sellers and buyers (or something like that! :) ). Pricing anomolies are short term in nature and usually do not exist for long if ever and the market tends to revert naturally and quickly back to its "true" and "fair" price.

As you'll see later (maybe) I believe the theory is out of line (slightly) with reality. This might (partially) explain why having an econ PhD doesn't necessarily enhance ones trading results.

Probabilities & Reversion to the "mean"

When pricing assets (like stocks, eg), while present values are important, what really gets people interested is the *future* value of a given asset or security (house or stock option, e.g.)

"yeah, like, um....'duh', fubarrio. so what?"

This is where probabilities come into play and eggheads start scribbling down random greek letters and arcane symbols in an attempt to bewilder the lesser minded canines amongst us, like yours truly.

Now, if fuBarrio hadn't been so slothenly his Junior year at the University, had the class been a *little bit* later in the day, had his professor's Chinese accent been even remotely understandable, fuBarrio might have a firmer grasp of statistics. Alas, we'll have to make due with my simpleton explanation.

Eggheads like to predict that a stocks future price will fall somewhere within a "distribution" of potential future prices. In a perfect world, this would be a standard distribution around some expected future price, with the probability curve being fattest where the future price would most likely come out ---shortest at the outlying extremes -- your standard bell curve.

The idea is that each "tick" has some probability of being up, and some probability of being down. After some X number of ticks, the price will most likely fall within some standard distribution type pattern.

ok, clearly I'm out of my depth in a parking lot puddle when it comes to statistics, and yet I press on with this tasty bit -- just in case you were in danger of acquiring any real knowledge:

(to make things more complicated and keep us under the dinner table just in case our forepaws ever develop oppposible thumbs, the eggheads often instead use a "lognormal" curve...a curve with a non-symetrical shape. Lognormal curves are skewed, and don't look like standard bell curves.

Why?

Well, best I can make out is because a 50$ gain, followed by a 50% loss (or vica versa) leaves one with a 25% loss, not breakeven (-- as a casual observation by a card carrying member of the mathematics illiterati, like myself might at first assume).

"Uh...ok...have we strayed far enough from the point yet?"

I think so, but in some vain attempt to bring it back, I will point out that the "crux" of all this probability talk though is the concept of "reversion to the mean".

"Reversion to the mean" as I understand it means that given a large enough sample size, things will tend to average out....A classic example (I guess) is flipping a coin. Even though you may have a string of dozen or so "heads" in a row, after enough flips, one would expect the number of heads to be roughly 50%. (If you aren't a lazy dog like fuBarrio you can google any of these terms and have a deeper more meaningful understanding in 30 seconds).

So, people will insist that markets will tend to "revert to the mean" of historical precedents in either pricing or fundamentals which will eventually drive pricing. As it so happens, this is effectively at the crux of some of fuBarrio's "US residential housing or the dollar or both must go down" arguments....for instance when he points out in exasperation that median incomes to median prices (or some other historical measure is completely out of whack!)

....so does that mean he is/was wrong?

No, but the theory of reflexivity helps explain why while he he was right, he sold two years too early.

So, fuBarrio, armed with your doggie wit and C minus in elementary statistics, why aren't you a trading superstar bazillionaire like George Soros, and furthermore, why do so many economists suck at trading?

"Trending" markets and reflexivity's role

Reflexivity, in this context, means an asset (or security) price's ability to effect its own price.

huh?

Reflexivity is a bit like a computer programmer's recursive function call. The function, in effect, calls itself until some preset condition is met (or the open loop hogs all the cycles and available memory) :)

In the interest of brevity (yeah right) I'll only use two examples to make my point.

Housing:

I'm using housing as an example of a reflexive market on the way down. However, the same principles work in reverse on the way up.

If we accept the fact that a certain number of homes around the world were being bought with:

1.) equity withdrawals from previously "purchased" real estate.

2.) money earned from sales, construction, financing, etc of houses during the boom

Then, it is perhaps not difficult to imagine that once affordability exhausts itself, real estate will enter into a "self reinforcing" downward spiral....or a "reflexive" relationship where its future price movement is strongly influenced by its immediately preceding price movement.

As rate resets, unemployment, overbuilding, unaffordability start to slow sales, builders and home owners with lots of equity will be the first to lower prices to raise cash. These lower prices will affect comparable sales, used in appraising the value of other homes in the neighborhood, for the purposes of sales or home equity withdrawals. As more people who represent buyers at the fringe have trouble staying liquid, credit standards will eventually have to get tougher.

It doesn't take much of an imagination to see that once the "cracks" start in a market driven by speculative excesses, the bottom won't likely be reached until it is as cheap as or cheaper to buy than to rent.

Reflexivity in an up market:

Where reflexivity in a down market is characterized by liquidity constriction and fear, the opposite is true for reflexivity in an up market. It is driven by greed and liquidity expansion.

Well how does that work?

Let's suppose that fuBarrio (or someone who is actually respected) starts touting Uranium as an investment (as an example). If there is no positive price movement, or negative price movement, it is quickly dismissed and you say, "well, duh....a bald dog with bad teeth and empty grey eyes can't spot a trend" and that is that.

If however, the prediction proves correct in the short term, people start to think that fuBarrio's hair must've fallen out after extensive radiation poisoning during research in underground U3O8 mines.

You think, "He must know something. That balding, spotted mutt fubarrio is rakin it in on Junior Uraniums and he only got a C minus in stats at that crappy school of Huskies! If I have to put up with all his meglomaniacal rants, I'm going to benifit a little too. I'm gonna follow his lead...."

If your make a little money, you tell friends about your astute stock picking, and they want a taste, new miners are able to raise money in IPO's, private placements, and secondary offerings. Winners from the sector cash in winnings and put them on new stocks (often in the same sector)....until the quality of investments and the prices being paid for speculation are so out of wack that the world runs out of "greater fools".

So, reflexivity is an attempt to explain part of the rationale behind, "the trend is your friend" and "The markets can stay irrational longer than you can stay liquid." Rather than be pulled by an invisible hand to some "correct" price, greed, fear, and the power of reflexivity will create markets that oscillate, constantly pushed away from our concept of "neutral" or "correct" pricing.

ciao,

fB

Some pics of beautiful Montevideo

Ok....I'm giving everyone what they want....A few pictures of beautiful Montevideo before returning you to my mind-numbing-wall-of-text (tm) posts on everything BUT Uruguay :)

Ok....I'm giving everyone what they want....A few pictures of beautiful Montevideo before returning you to my mind-numbing-wall-of-text (tm) posts on everything BUT Uruguay :)1.)The first picture is of the old abandoned MVD train station...not in use (unbelievable!)

2.)A church in Pocitos

3.)Williman road, in Punta Carretas...very comfortable brick paved street, close to and home to a couple of my favorite restaurants.

4.)Sunset off fuBarrio's rear terrace.

5.)"Shaky paw" night shot off of fuBarrio's front terrace.

If you are in the northern hemisphere, you probably don't even want to know how gorgeous the weather was today -- church shot and Williman road were taken today....others this past week.

ciao, fB

Wednesday, December 06, 2006

OK....what'll $84k buy me?

Fubarrio and Golden Lotus ventured once more into the great wild world of trying to find a place to live in Montevideo this last week.

Fubarrio and Golden Lotus ventured once more into the great wild world of trying to find a place to live in Montevideo this last week.We found some things that were very interesting. Sadly for fuBarrio and GL, fuBarrio's small monthly stipend check (a settlement from the failed 'dna replacement therapy' that left fuBarrio a dog in bad need of some orthodontics, the hairclub for canines, and aggressive plastic surgery) doesn't cover the "nut" on the featured house here.

Before you ask, "no", the house does not come with the old guy out front either -- he is however useful for appreciating the "scale" of the house.

The house is located in "Prado". Prado is the old original "residential" neighborhood (read: burbia). However, it is the burbia before cars were as common as they are now, so it's a little closer in than the new "burbia" (Carrasco). Prado has some *very nice* older homes that go for 5X the cost of this one.

Once you enter the home there is a narrow hallway, VERY high ceilings (throughout) -- between 12 -15 feet, doorways leading to 'sitting' rooms on either side.

The center of the house, through the doorway in the middle of the first picture, has a large atrium area with a glass skylight (there are actually two of these skylight rooms, one further back in the house as well).

The entire house is VERY well laid out, flows well. The last picture is the rear room and one of the doors that lead outside (with the colored glass). fB's foto skills are pretty poor, and trying to capture scale was difficult (shoulda put the old guy in each picture! :) )

Click on a couple of the pictures and check out the details of the floor. The house was a bit dusty on the inside, and it makes it look like somebody's old linonleum (or something e equally hideous) back in the states. But this is actually the original painted tile from the 30's in each room throughout the center of the house.

The rooms on the each side of the house (not pictured) had wooden floors that were the most obvious thing in need of fixing (very old/soft/creaky). The kitchen had been "refurbished" but that really just meant putting in new countertops since the Uruguayos don't like including appliances with homes (or apts for that matter!)

The rooms on the each side of the house (not pictured) had wooden floors that were the most obvious thing in need of fixing (very old/soft/creaky). The kitchen had been "refurbished" but that really just meant putting in new countertops since the Uruguayos don't like including appliances with homes (or apts for that matter!)A nice house, but once we figured out that they meant 84K DOLLARS, and not uruguayan pesos it was quickly obvious it was out of *our* price range.

Rather than focus on fuBarrio's obvious lack of skills as a provider, GL was kind enough to rationalize it away as being too far from the center of town for our particular transportation needs....(for some reason or another the Uruguayos are reluctant to let someone that looks like a hairless dog have driving privileges).

Uh...I don't know about you, but this looks like it has a little more potential that your typical $429k new construction sh*tbox 75 minutes from any culture or employment opportunities in the "other America"-- but if you came here you'd have to miss out on the fun of paying that $5k in property taxes each year.

So, I guess like anything else, you gotta take the good with the bad! :)

peace,

fuBarrio

p.s. to try to appreciate the scale of the home, click on the picture with the "colored glass" door. if you can, see if you can spot the door handle. the door handle is at the proper height for a full grown European (not "Tatu") :)

Tuesday, December 05, 2006

"It's Not about the Money....

GL was remarking the other day, "geez fuBarrio, for someone without a lot of money, you sure spend a lot of time thinking and talking about it."

uh, good point. But, for that matter, for someone without opposible thumbs on their forepaws, I spend alot of time online too.

So, why all this obsession with the alweakly dollar (TM) on a blog supposedly about living in South America as a US Expat?

Well, for better or worse, the expense of living here factored in a BIG way in deciding on Montevideo. Although relatively inexpensive, it is clearly not the *cheapest* place on the planet to settle, but I wasn't really looking for the cheapest. I was looking for the "best value".

For different people, "value" means different things.

For me, my dream was to have a time machine and live in Europe in the 50's....back when mere mortals and hairless dogs could afford a nice quality of life as out of work expats. I never lived in 1950's Europe, but this is *close* to how I'd imagine it:

relative security

de-emphasis on US pop culture

gentle climate

lots of fresh foods -- fast food still very rare (novelty)

inexpensive

emphasis on free time

de-emphasis on "car culture"

Of course the fact that nearly everyone here *is* European helps complete the illusion!

Monday, December 04, 2006

Of Markets and Men.....

Fubarrio's first theorem of back luck (TM) states that: the mere act of talking positively about any asset class (or new relationship, or job prospect, etc) will have (almost) immediate and catastrophic short term consequences on said speculation (or aspiration's) positive outcome.

I will be reporting on the stated assets listed below (especially the Uranium juniors) in the next couple of weeks that follow so as to test the theory -- anecdotally obviously! :)

I even have a theory for why the first theorem seems to hold so often, but I won't get into that unless this little experiment gives everyone a very public viewing of fB's first theorem in practice. )

Ok, now the post:

Great Bull markets and bubbles seem to all follow a well-worn path to speculative excesses.

I've been taught the hard (read: expensive) way that these two old sayings still hold true today:

"The trend is your friend" and

"The market can stay irrational longer than you can stay liquid"

The second quote is attributed to Keynes, the first is unkown (Jesse Livermore?), but he must have been a trader.

Great amounts of speculative capital can be amassed by trend following as long as you are willing to sell "too early" (rather than "too late"). In thinking (briefly) about the two quotes above however we see that sometimes in trading, thinking, or trying to understand the "why" something is trending in a certain direction can be detrimental to your (financial) health.

That said, however, it is an invaluable asset to be able to recognize when the jig is "up"and a longn running trend is near or at a speculative apex and it is time to step aside or "flip the script".

As anyone who has read this blog knows, I've been "bearish" on US residential housing and bullish on metals, miners and energy. While I don't believe the energy bull is dead, in the last couple of months I've shifted a portion from carbon based energy to mineral based (U3O8).

A month or two ago in the face of crude oil, refined products and natural gas declines there was significant rumblings from mainstream media that the resource bull market was dead.

While pullbacks will be extremely violent and decimate portfolios, the bull will not be deceased until AFTER it becomes a speculative fervour....

Remember when housewives were selling formed silver to traders for the metal content in 79/80....I was 10 and 11 years old and *I* was caught up and fascinated by the run-up....granted I was uniquely alert to all things financial as a yougster, but i took a portion of my paper route earnings not wasted on candy and baseball cards and bought silver ingot :) (--- AFTER the bubble had collapsed -- on the way down....becauase it was a better price! the "greater fool" ....so young to be a knife catcher!! :) )

Ironically, the fact that *I* was fascinated by the precious metal bull market as an 11 year old would have been the warning bell to the me 25 years older. I hopefully would have seen the paperboy interested in buying ingot as a sure sign that the great bull needed a "little" 18-20 year "cleansing" period to wash out the speculative excesses.

When cocktail party chatter is abuzz with gold mining stock profits, when you hear stories of everyday people making vast sums of wealth betting on junior Uranium miners, when a cab driver/waitress/homeless person/shoe shine boy/barber/mailman, etc starts telling you about their ingot or silver mining stock picks, you'll know it's time to park your funds in safer harbors. Until then, buy the dips.

If you need reminders of what speculative excess looks like, think about realestate in 2004-2005, dot-coms in 1999-2000, nikkei and japanese realestate 1989, oil in the early 80's, precious metals 79-80. (the last two I'm too lazy to look up, but hopefuly that is a reasonably accurate ballpark)....There are also several more I never lived through- nifty fifty late 60's - 1929, etc.

Ok...so, how do I know that I'm not STILL the greater fool and I should add "expatriate blogging from South America" to the list of everyday people??? Because right now the only people that agree with me are still viewed as "fringe" and a little cooky by "normal" people :)

ciao for now,

fB

GL was wrong!!!

Hola peeps! sorry for not writing so long. i have been lazy. anways, on the topic of being wrong. i was and am wrong, for those that know me very well i hold very strong beliefs, specially about Tibetan Buddhism (TB) and his Holiness (HH).

okay, so for a long time i lived very a "strict-path" so one of the aspects of what i thought was the right "path" was to stay away from eating any kind of meat. i did. i also did not have any leather goods or fur.

however, in doing my research and studies about TB i realized that they were and are big meat eatters. Ha! so much for right path thing GL!!! even HH eats meat. so, who am i? noone special just a human being like the other meat eatters out there trying to survive.

HH says it's important to have a open mind and beable to work with what you have. i live in a wonderful country that just so happens to be one of the top countries for meat production. and, here i am trying to figure out how i am going to prepare food for fb and i.

well, i think, that if i am trying to pratice TB i should practice it right, which mainly focuses on compassion towards all sentient beings and so on and so on. so, there. i am wrong. for those of you who might of got offended by my last post. sorry. i am only a simple human being.

FREE TIBET!!!

Friday, December 01, 2006

I'm a little bit "country"

Our friends were gracious enough to invite us out to their mini-hacienda out in the "country" this last weekend.

Their son stopped by our home on Sunday morning and drove us out from the city. This was (gasp!) our first time leaving Montevideo since arriving in Uruguay. Pretty sad, I know! :)

But, we are planning on doing a lot more traveling now that the weather has turned for the better (absolutely gorgeous).

Here are a couple of pics I snapped. Their "hacienda" sits very close (couple of kms) from the coast, in the southern part of Uruguay where the river meets the ocean....Near "piriapolis", about 1/2 hour from Punta del Este (i'm guesstimating here).

The last shot is a blurry snap that I took out of the moving car in at the end of the day in an attempt to capture the sunset. The pic, of course, doesn't really do it justice, but hopefully, using your imagination, you can appreciate how cool it was. :)

The last shot is a blurry snap that I took out of the moving car in at the end of the day in an attempt to capture the sunset. The pic, of course, doesn't really do it justice, but hopefully, using your imagination, you can appreciate how cool it was. :)